3rd Member Testing Opportunity Saturday, July 9

IEX Trading Alert #2016-024

Please Route To: Please Route To: Trading, Business, Market Data Technology, Technology, and Trade Support

What you need to know:

- IEX will transition the IEX ATS to Investors Exchange (the "Exchange") beginning August 19, 2016.

- There are three (3) remaining Saturday test opportunities, the next of which will occur on Saturday, July 9.

- During the July 9th Saturday test, participants should expect the following Exchange behavior:

- The Investors Exchange FIX Specification will be enforced.

- Matching logic will enforce the Exchange Rule Book.

- The routing options and architecture will operate as per Exchange Rule Book.

- "Exchange-only" TOPS (v1.5) will be available for symbols transitioned to the Exchange for the Saturday test (in addition to current TOPS v1.4 for all symbols)

- IEX quotation and trade information will be published on the SIPs for symbols transitioned to the Exchange for the Saturday test.

- IEX will be publishing trades and quotes to both the ASCII and binary UTP feeds.

- OATS will attempt to match Route and Combined Order/Route Reports submitted to OATS CT against the Exchange Order Data.

- OATS Route and Combined Order/Route Reports for the IEX Router will also be produced and submitted to OATS CT.

- Clearing files from Saturday's trade data will be available directly from NSCC on Monday, July 11.

- Those who are not current IEX ATS Subscribers who wish to test on Saturday, July 9 must submit all required Connectivity Agreements and Forms to IEX Market Operations, and such forms must be approved by IEX by Tuesday, July 5.

- Additionally, new Members and Service Bureaus must complete a successful certification in IEX's Certification environment prior to participating in a Saturday test.

- Application and agreements for broker membership, service bureau access, or sponsored access must be submitted to IEX by Tuesday, July 5 to be eligible for participation.

What is the timing, scope, and connectivity details for the Saturday test?

Timing

The IEX Production system will be available from 8:00 a.m. to 1:00 p.m. ET on Saturday, July 9 for testing functionality of Investors Exchange.

- 8:00 a.m. - 9:30 a.m. ET: Pre-Market Session

- 9:30 a.m. - 12:00 p.m. ET: Regular Market Session

- 12:00 p.m. - 1:00 p.m. ET: Post-Market Session

Connectivity

Scope

During the test, the following securities will transition to the Exchange, while all other securities not listed below will remain on the IEX ATS:

- Test symbols: CBO, CBX, ZBZX, ZJZZT, ZTEST, ZVV, ZVZZT, ZWZZT, ZXZZT

- Non-test securities: All symbols starting with 'Y' - 'Z', VALE.P, VG, VHC, VIAV, VIP, VLY, WIN, XOMA

For current IEX ATS Subscribers, all IEX functionality will be available on all securities, e.g. matching, routing, quoting. TOPS v1.4 will publish quotations on all symbols. TOPS v1.5 will publish quotations and trades on only the symbols that have transitioned to the Exchange for the Saturday test.

For participants who are not current IEX ATS Subscribers, all functionality of IEX will be available limited to symbols that have transitioned to the Exchange for the Saturday test.

Assistance

For any questions or issues during Saturday's test, please contact IEX Market Operations at 646.343.2300 or MarketOps@iextrading.com.

How does the Investors Exchange FIX Specification differ from the ATS FIX Specification?

Identifying Exchange Executions

For the securities that migrated to the Exchange for Saturday's test, IEX will populate two (2) new FIX tags on Execution Report and Trade Bust messages for executions from away venues and on the IEX Order Book, in accordance with the Investors Exchange FIX Specification.

- NoContraBrokers (382) = 1

- ContraBroker (375) = IEXG

Executions processed on the IEX ATS will not populate NoContraBrokers (382) or ContraBroker (375).

Routing Options

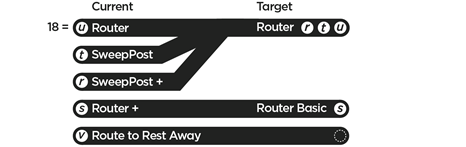

The following routing options will be replaced by the newly announced routing options, Router and Router Basic:

- Route to Rest; a.k.a. SweepPost+ (18=r)

- Route to Rest with Resweep; a.k.a. Router+ (18=s)

- Route to Take; a.k.a. SweepPost (18=t)

- Route to Take with Resweep; a.k.a. Router (18=u)

The following two new (2) routing options will be provided as a replacement for the four (4) options listed above. The two new routing options will use existing FIX Tag 18 (ExecInst) values in the Exchange FIX Specification. Therefore, participants may use the two new routing options without configuration changes.

- Router (18=u) (Note that 'r' and 't' are accepted and converted to 'u')

- Router Basic (18=s)

The following routing option will be retired for all symbols; there will be no replacement or mapping for the below option, so orders with utilizing this option will be rejected:

- Route to Rest Away (18=v)

The following diagram illustrates how today's current routing options will be mapped to the new target routing options:

Default Behavior Port Setting

The Default MaxFloor (111) Override port setting will not be available, which means the MaxFloor (111) value will be used to define the number of shares displayed on the Exchange. If MaxFloor (111) is left blank, IEX will no longer default to "0" (zero) for limit orders, and the entire limit order quantity will be displayed. Omission of MaxFloor (111) for pegged orders will continue to express non-displayed pegged orders only.

Additionally, the port setting to convert orders with a time-in-force ("TIF") of SYS or GTX to a TIF of DAY will not be available.

What changes should participants expect in the Matching Engine?

Broker Priority will not be enforced for any securities during the test. Orders will be matched according to Price-Display-Time book priority.

Additionally, unlike displayed orders for securities on the ATS, displayed orders for securities that have migrated to the Exchange on Saturday will be subject to the "price sliding process" pursuant to IEX Rule 11.190(h). Displayed orders for securities that have migrated to the Exchange will no longer be subject to the Midpoint Price Constraint, which will now only apply to non-displayed orders on the Exchange.

An order eligible for display by the Exchange that, at the time of entry, would create a violation of Rule 610(d) of Regulation NMS by locking or crossing a Protected Quotation of an external market will be ranked and displayed by the System at one (1) MPV below the current NBO (for bids) or one (1) MPV above the current NBB (for offers) ("display-price sliding"). An order subject to display-price sliding will retain its limit price irrespective of the price at which such order is ranked and displayed. In the event the NBBO changes such that an order subject to display-price sliding would no longer lock or cross the Protected Quotation of an external market, the order will receive a new timestamp, and will be displayed at the most aggressive permissible price. Such orders may be re-priced once, or more than once, depending on changing market conditions and the order's limit price.

In the event that the market becomes locked, the System will observe the following practices for displayed orders:

- Resting orders that are displayed at the price of the locking quotation ("locking price") as defined in IEX Rule 11.310, and were originally displayed in compliance with rules and regulations of the Exchange and the Exchange Act of 1934 will maintain their displayed price and quantity.

- Displayable orders posting to the Order Book on the same side as an order which is locked and was originally displayed, as per the above statement, are not permitted to join the locking price. Such orders will be displayed and ranked by the System pursuant to the Exchange's display-price sliding practices described above.

In the event that the market becomes crossed, the System will observe the following practices for displayed orders:

- Resting orders that are displayed at a price which has become crossed and were originally displayed in compliance with rules and regulations of the Exchange and the Act will maintain their displayed price and quantity.

- Displayable buy (sell) orders being posted to the Order Book during a crossed market will be displayed and ranked by the System one (1) MPV below (above) the lowest Protected Offer (highest Protected Bid).

What changes should participants expect to the IEX Router?

IEX will offer the following two (2) new routing options for securities that have migrated to the Exchange for Saturday's test.

- Router (18=u) (Note that 'r' and 't' are accepted and converted to 'u')

- Router is a routing option under which an order is sent to the IEX Order Book to check for available shares and then any remainder is sent to destinations on the System routing table, which may include the IEX Order Book. If shares remain unexecuted after routing, they are posted on the Order Book or canceled, as per User instruction. Once posted on the Order Book, the unexecuted portion of such order is eligible for the re-sweep behavior. This routing strategy is most similar to the existing Route to Take with Resweep (a.k.a. Router).

- Router Basic (18=s)

- Router Basic is a routing option under which an order is sent to destinations on the System routing table, including the IEX Order Book. If shares remain unexecuted after routing, they are posted on the Order Book or canceled, as per User instruction. Once posted on the Order Book, the unexecuted portion of such an order is eligible for the re-sweep behavior.

Additionally, for securities that have migrated to the Exchange on Saturday, all communication between the IEX Router and the Exchange will be subject to an additional 350μs of latency, meaning orders from the IEX Router to the IEX Order Book, and quote data and fills from the IEX Order Book to the IEX Router will experience the additional 350μs of latency. No additional latency will be placed between the IEX Router and away markets.

How will IEX display orders for securities that have transitioned to the Exchange?

Existing TOPS feed (TOPS v1.4)

There will be no change to the existing TOPS feed (TOPS v1.4) during the Saturday test; TOPS v1.4 will continue to publish the aggregated best quoted bid and offer for all securities, including securities on both the IEX ATS as well as those transitioned to the Exchange (TOPS v1.4 does not and will not distinguish between IEX ATS and Exchange securities).

Exchange-only TOPS feed (TOPS v1.5)

The "Exchange-only" TOPS feed (TOPS v1.5) will publish the aggregated best quoted bid and offer (i.e., top of book) exclusively for securities that have transitioned to the Exchange during the Saturday test.

Note that TOPS v1.5 will be published on different multicast addresses than TOPS v1.4, so Data Recipients must submit the necessary Exchange Data Agreements and Forms prior to being configured.

How will IEX be identified on the SIP?

IEX will be identified in CTA (CQS/CTS feeds) and UTP (UQDF/UTDF legacy feeds; i.e., ASCII feeds) with a Market Center Originator ID of "V". See the CTA or UTP websites for technical specifications, the latest are linked below:

- CTA Quotation Data Feed (CQS)

- CTA Trade Data Feed (CTS)

- UTP Quotation Data Feed (UQDF)

- UTP Trade Data Feed (UTDF)

IEX will also be identified on the UTP binary feed with a Market Center Originator ID of "V". See the UTP website for technical specifications, the latest is linked below:

- UTP Data Feed (trades and quotes)

How can participants test OATS?

FINRA has assigned the Exchange a Destination Code of "XV".

After the test on Saturday, OATS will attempt to match Route and Combined Order/Route Reports submitted to OATS CT against the Exchange Order Data. Additionally, IEX will produce and submit OATS Route and Combined Order/Route Reports to OATS CT for the IEX Router. IEX recommends that participants also produce and submit OATS Route and Combined Order/Route Reports to FINRA.

How can participants test clearing and settlement?

Trades matched on IEX will be disseminated to the National Securities Clearing Corporation ("NSCC"), which will process clearing and settlement.

- All clearing records sent to the NSCC by IEX will be submitted to NSCC PSE environment on Monday, July 11 using the Universal Trade Capture ("UTC") format.

- Clearing files will be made available by the NSCC by end of day Monday.

- Members and their clearing agent systems should be prepared to handle clearing for IEX in UTC format.

- Client output will carry the Exchange's UTC Market Code of "170".

- For more information regarding the UTC format, please refer to https://www.dtcclearning.com/learning/clearance/topics/universal-trade-capture.html.

Who is eligible to participate in the scheduled Saturday tests?

Members, Service Bureaus, Sponsored Participants, and Extranet Providers

Those who are not current IEX ATS Subscribrs who wish to access the IEX system for order entry and execution must submit all required Connectivity Agreements and Forms, and such forms must be approved by IEX on the Monday prior to a Saturday test to be eligible for participation. Additionally, new Members and Service Bureaus must complete a successful certification in IEX's Certification environment prior to participating in a Saturday test. The first page of the document provides a checklist of the agreements and forms required from each type of participant.

Additionally, application and agreements for broker membership, service bureau access, or sponsored access must be submitted to IEX by the Monday prior to a Saturday test to be eligible for participation (IEX approval prior to testing is not required for these documents). The checklist on the first page of each document below outlines the required application, agreement, and forms for each participant:

- Waive-In Member / Member Application

- Service Bureau Application

- Sponsored Access Application

- Extranet Provider Connectivity

Current ATS Subscribers and technology partners are eligible to participate in a Saturday test without submitting applications or agreements, but will not be eligible to submit orders on the Exchange on the Launch Date without first being an approved Member or participant.

Data Recipients

Those who wish to access IEX's system for the receipt of IEX's data products (e.g., TOPS) must submit all required Data Agreements and Forms and such forms must be approved by IEX on the Monday prior to a Saturday test to be eligible for participation. The first page of the document provides a checklist of the agreements and forms required.

Current Data Recipients of the ATS will continue to receive TOPS via their existing connections.

Newly Connecting Participants

Those who require new physical connections to IEX, please plan accordingly to ensure the physical connectivity is ordered at least two (2) weeks in advance of the test you wish to participate in.

When can a participant test Exchange functionality, including consuming IEX trades and quotes from the SIP?

IEX will offer the following Saturday testing opportunities in advance of the Exchange launch:

- March 5: 1st Member Testing Opportunity (COMPLETE)

- June 4: 2nd Member Testing Opportunity (COMPLETE)

- July 9: 3rd Member Testing Opportunity

- July 30: 4th Member Testing Opportunity

- August 13: 5th Member Testing Opportunity

During each Saturday test, the IEX Production system will available from 8:00 a.m. to 1:00 p.m. ET for testing functionality of the Exchange.

Test data is available nightly directly from the SIPs.

- CTA: Test data is disseminated from CQS/CTS on business weekdays from 9:00 - 9:15 p.m. ET from the multicast Playback Test channels (not over Production channels).

- UTP: A test file is recorded to be replayed in the evenings from 9:00 p.m. to 10:30 p.m. ET to all UTP data feed subscribers. Evening test data is provided over the production IP services during the designated times. No registration is required to participate in evening testing.

Where can I learn more?

- Become a Member of Investors Exchange.

- View the Investors Exchange User Manual.

- Contact IEX Sales at 646.343.2100 or Subscriber@iextrading.com.

- Contact IEX Market Operations at 646.343.2300 or MarketOps@iextrading.com.

- IEX Frequently Asked Questions.

About IEX

Dedicated to institutionalizing fairness in the markets, IEX provides a more balanced marketplace via simplified market structure design and cutting-edge technology. IEX operates a fair-access platform accessible by any qualified broker dealer. IEX is driven by a team of cross-industry experts with backgrounds spanning market venues, electronic trading, and broker-dealers. IEX is the first equity trading venue seeded exclusively by a consortium of buy-side investors, including mutual funds, hedge funds, and family offices. Learn more at: iextrading.com.