Introducing the Router Redesign and New Routing Options

IEX Trading Alert #2016 - 020

Please Route To: Please Route To: Trading, Operations, and Trade Support

What you need to know:

- On Friday, June 17, the SEC approved the Investors Exchange (the "Exchange" or "IEX") application.

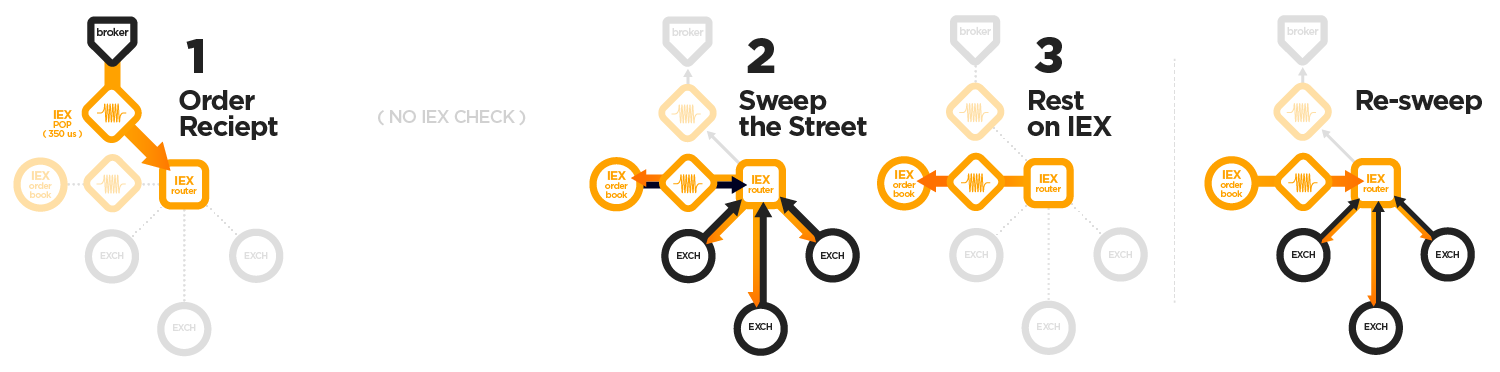

- In preparation for the Exchange launch, and as detailed in the Exchange Rule Book, IEX will be launching a redesigned IEX Router (i.e. the IEX SOR) that places an additional 350 microseconds ("μs") of latency between the IEX Router and the IEX Order Book.

- All orders from the IEX Router to the IEX Order Book will experience an additional 350μs of latency.

- All quotes and fills from the IEX Order Book to the IEX Router will experience an additional 350μs of latency.

- Refer to the IEX Rule 11.510 for a detailed description.

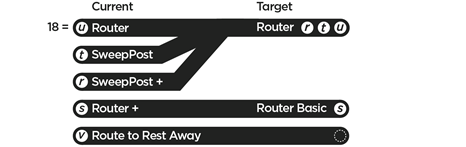

- As part of this effort, IEX is simplifying its 5 existing routing options into two new options: Router and Router Basic.

- IEX does not expect this change - which retires rarely used routing options - to have any material impact on IEX Subscribers.

- IEX does not expect the above changes to impact fill rates for participants using the IEX Router.

- The above changes will be rolled-out to the IEX Alternative Trading System ("ATS") using a security-by-security phase-in approach from Monday, July 18 to Friday, July 22.

- During the Member Testing Opportunity on Saturday, July 9, all securities in the Y-Z letter range will be available for testing the above changes.

- Beginning Monday, July 11, test symbols will be available for testing the above changes.

- These changes will persist as the IEX ATS transitions to the Investors Exchange.

Which of the IEX Router interactions will be subject to the additional 350μs of latency?

All communication between the IEX Router and the IEX ATS will be subject to an additional 350μs of latency, meaning orders from the IEX Router to the IEX Order Book, and quote data and fills from the IEX Order Book to the IEX Router will experience the additional 350μs of latency.

No additional latency will be placed between the IEX Router and away markets.

Current Configuration

|

Target Configuration

Any interaction between the IEX Router and the IEX Order Book is designed to experience 350μs of latency through the POP.

|

What impact will the additional latency have on the IEX Router fill rates?

IEX does not anticipate an impact on fill rates the IEX Router obtains. While participants may execute less shares on the IEX Order Book, the overall fill rate is not anticipated to change.

IEX will continue to publish fill rate statistics on the IEX website during this transition. Any participant-specific questions may always be directed to Market Ops or Sales.

What are IEX's new routing options?

IEX will introduce the following two (2) new routing options (roll-out details and timing are outlined below).

- Router (18=r,t,u)

- Router is a routing option under which an order is sent to the IEX Order Book to check for available shares in a way designed to minimize market impact (see below for additional detail*) and then any remainder is sent to destinations on the System routing table, which may include the IEX Order Book. If shares remain unexecuted after routing, they are posted on the Order Book or canceled, in accordance with User instruction. Once posted on the Order Book, the unexecuted portion of such order is eligible for the re-sweep behavior. This routing strategy is most similar to the existing Route to Take with Resweep (a.k.a. Router).

- Router Basic (18=s)

- Router Basic is a routing option under which an order is sent to destinations on the System routing table, including the IEX Order Book. If shares remain unexecuted after routing, they are posted on the IEX Order Book or canceled, in accordance with User instruction. Once posted on the Order Book, the unexecuted portion of such an order is eligible for the re-sweep behavior.

The below diagram illustrates the Router and Router Basic routing options:

Router

|

Router Basic

|

*How does the Router routing option minimize market impact (i.e., liquidity fade) after an IEX Check?

The IEX Router "checks" IEX by routing the entire order with either an FOK or IOC time-in-force to the IEX Order Book. Depending on the size of the order and the cumulative shares from protected quotations at the NBBO (the "PBBO"), the IEX Router will choose one of the techniques below to minimize market impact (i.e., liquidity fade) from any fills received on the IEX Order Book.

Undersized Order

If the routable order size is substantially smaller than the cumulative shares at the PBBO (e.g., 1000 share routable buy order compared to a cumulative PBO of 5000 shares), the IEX Router checks the IEX Order Book to the PBBO with a standard IOC (no minimum quantity condition) because the risk of missing shares due to liquidity fade is low.

All Other Orders

Otherwise, the IEX Router checks the IEX Order Book to the PBBO using an FOK time-in-force (i.e., minimum quantity equal to order size), meaning the order must be completely filled or no execution occurs, so as to not create a signal unless the order is fully executed on IEX.

How will the IEX routing options be simplified prior to the Investors Exchange launch?

The following routing options will be replaced on the ATS security-by-security (roll-out outlined below) by the new routing options beginning Monday, July 18, 2016 and ending Friday, July 22:

- Route to Rest; a.k.a. SweepPost+ (18=r)

- Route to Rest with Resweep; a.k.a. Router+ (18=s)

- Route to Take; a.k.a. SweepPost (18=t)

- Route to Take with Resweep; a.k.a. Router (18=u)

The following two new (2) routing options will be provided as a replacement for the four (4) options listed above beginning Monday, July 18, 2016. The two new routing options will use existing FIX Tag 18 (ExecInst) values in the IEX FIX Specification. Therefore, Subscribers may use the two new routing options without configuration changes.

- Router (18=r,t,u)

- Router Basic (18=s)

The following routing option will be retired for all symbols on Monday, July 11, 2016; there will be no replacement or mapping for the below option, so orders with utilizing this option will be rejected:

- Route to Rest Away (18=v)

The following diagram illustrates how today's current routing options will be mapped to the new target routing options:

What is the security-by-security deployment plan for the new routing options?

The current routing options will be replaced with Router and Router Basic for the securities identified on the dates listed below. Current users of the IEX Router are not required to make changes in order to use the new routing options as they are introduced.

Test Phase

- Saturday, July 9: During the Member Testing Opportunity, all symbols in the Y-Z letter range will be available for testing the new routing options.

- Monday, July 11 - Friday, July 15: Test symbols (CBO, CBX, ZBZX, ZJZZT, ZTEST, ZVV, ZVZZT, ZWZZT, ZXZZT)

Live Phase

- Monday, July 18: Two non-test securities (VG, WIN)

- Tuesday, July 19: Ten non-test securities (VALE.P, VG, VHC, VIAV, VIP, VLY, WIN, XOMA, YINN, ZIOP)

- Wednesday, July 20: All symbols starting with 'Y' - 'Z', VALE.P, VG, VHC, VIAV, VIP, VLY, WIN, XOMA

- Thursday, July 21: All symbols starting with 'V' - 'Z'

- Friday, July 22: All symbols ('A' - 'Z')

Why is IEX making these changes to the IEX Router?

IEX is adding 350μs of latency via the POP for interactions between the IEX Router and the IEX Order Book in response to comments received during the comment period of IEX's exchange application to provide the IEX Router with the same latency in accessing the IEX Order Book as any third-party broker would experience. IEX submitted an amendment to its exchange application on March 7, 2016 which identified and described both the latency and routing strategy changes found in this Trading Alert. On Friday, June 17, IEX received approval from the SEC to become a registered exchange.

Where can I learn more?

- View the IEX ATS FIX Specification | Investors Exchange FIX Specification.

- Become a Member of Investors Exchange.

- View the IEX ATS Subscriber Manual |Investors Exchange User Manual.

- Contact IEX Sales at 646.343.2100 or Subscriber@iextrading.com.

- Contact IEX Market Operations at 646.343.2300 or MarketOps@iextrading.com.

- IEX Frequently Asked Questions.

About IEX

Dedicated to institutionalizing fairness in the markets, IEX provides a more balanced marketplace via simplified market structure design and cutting-edge technology. IEX operates a fair-access platform accessible by any qualified broker dealer. IEX is driven by a team of cross-industry experts with backgrounds spanning market venues, electronic trading, and broker-dealers. IEX is the first equity trading venue seeded exclusively by a consortium of buy-side investors, including mutual funds, hedge funds, and family offices. Learn more at: iextrading.com.